Electric Vehicle Tax Benefit Irs - The government is offering a hefty tax credit to buyers of electric vehicles, but taking advantage of it is not straightforward. Electric Vehicle Tax Credit Irs Electric Vehicle Tax Credit What To, Here’s what you’ll need to. The total amount of the credit is based.

The government is offering a hefty tax credit to buyers of electric vehicles, but taking advantage of it is not straightforward.

Electric Vehicle Tax Credit What Qualifies & How to Save Money KB, The bad news is that fewer vehicles are now eligible. Here's what you need to know.

Visit fueleconomy.gov for a list of qualified vehicles.

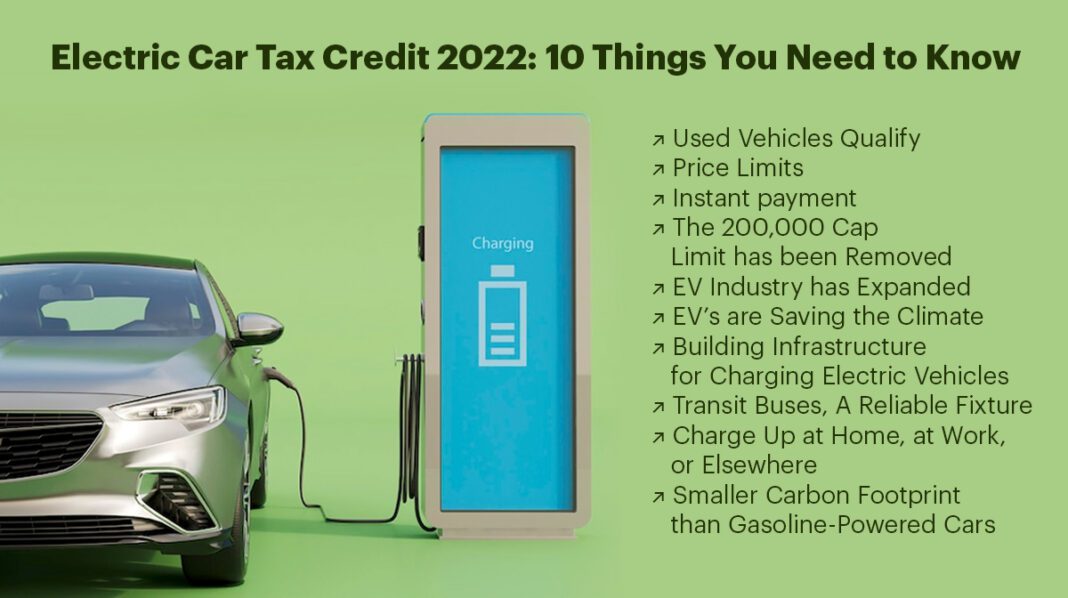

Fixing the Federal EV Tax Credit Flaws Redesigning the Vehicle Credit, Electric vehicles purchased in 2025 or before are still eligible for tax credits. The irs has made the ev tax credit easier to obtain, and in 2025 it’s redeemable for cash or as a credit toward the down payment on your vehicle.

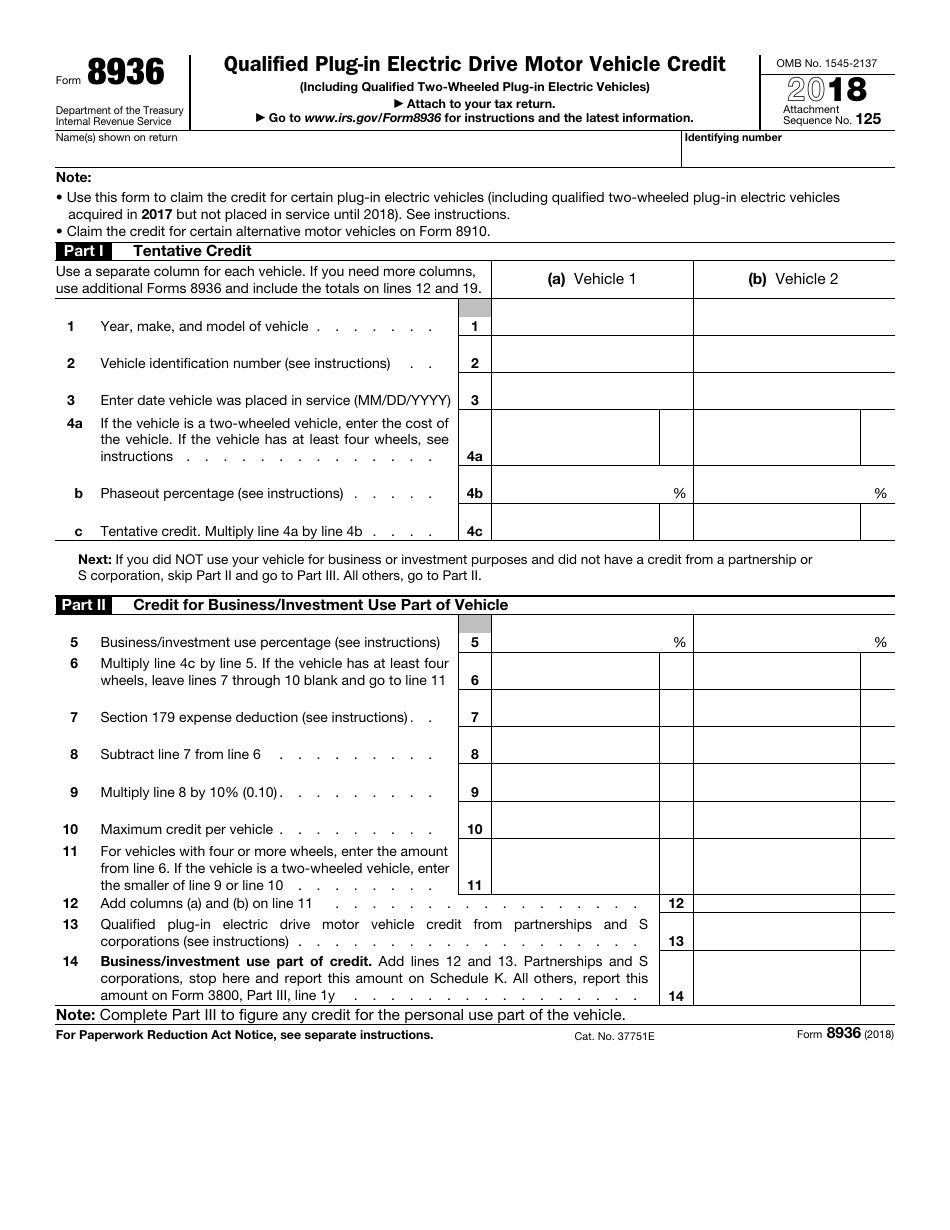

Electric Vehicle Tax Credit Explained 1800Accountant, From january 1 to april 17, 2023, credits were awarded in part based on the vehicle’s kilowatt hours of battery capacity. The total amount of the credit is based.

Federal incentives include a 30% tax credit up to $1,000 for electric car chargers and installation costs. The irs has made the ev tax credit easier to obtain, and in 2025 it’s redeemable for cash or as a credit toward the down payment on your vehicle.

What You Need To Know About Electric Vehicle Tax Credits Elmers Auto, Visit fueleconomy.gov for a list of qualified vehicles. Here's what you need to know.

Electric Car Tax Credit Everything that You have to know! Get, Treasury department said on thursday that electric vehicles leased by consumers can qualify starting jan. The total amount of the credit is based.

From january 1 to april 17, 2023, credits were awarded in part based on the vehicle’s kilowatt hours of battery capacity.

Electric Vehicle Tax Benefit Irs. The tax credit extends through dec. Do you qualify for the electric car tax credit?

Company Car Tax Benefits for Electric Vehicles Go Electric, The electric vehicle tax credit, also known as the “clean vehicle tax credit,” or 30d, if you like irs code, can offer up to $7,500 off the purchase of a new ev. $2,917 for a vehicle with a battery capacity of at least 5 kilowatt.